SanDisk BAD RESULTS

Technological SanDisk Corp introduced 1Q15 results, with EPS adjusted below expectations (USD 0.62 vs. USD 0.66) and revenues above the consensus (USD 1330 mn vs. USD 1.30000 mn).

The CEO proved to be “disappointed” with the results and said the company is taking steps to resume execution excellence demonstrated in the past.

The guidance for 2015 has been revised downwards and missed the market consensus – revenue of USD 5400 mn – USD 5700 mn vs. USD 6150 mn expected.

The sales target for USD 1000 mn companies was discarded, although the company renewed commitment of capital return to shareholders, with additional buy-backs of USD 750 mn this year.

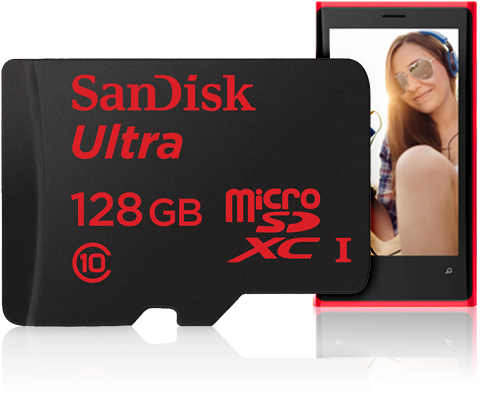

SanDisk Corporation is an American Company that designs, develops and manufactures flash memory storage solutions and software.

It was founded in 1988 by Dr. Eli Harari, Jack Yuan and Sanjay Mehrotra, technology experts.

The company is based in Silicon Valley and has more than half its sales outside USA.

Its products are sold at more than 260,000 retail locations in more than 100 countries. SanDisk became a publicly traded company on NASDAQ in November 1995. As of February 2015, its market capitalization was over US$17 billion.

Read more:

http://investor.sandisk.com/phoenix.zhtml?c=86495&p=irol-irhomemain

http://www.zdnet.com/article/sandisk-q1-2015-earnings-hardware-flash-memory/

NASDAQ AT 5000 LEVEL

In 2000 the top 3 NASDAQ companies were (1) MICROSOFT, (2) CISCO, and (3) INTEL.

Currently the three largest and most important companies are (1) APPLE (2) MICROSOFT and (3) GOOGLE.

During the last year the main company from this index, APPLE appreciated 18% and currently worth $757B.

For the first time since its dot-com era peak nearly 15 years ago, the NASDAQ COMPOSITE has closed above 5,000.

Major U.S. indexes rose from the start, with the Nasdaq passing the milestone number shortly before noon. The tech heavy index, rose again toward the close of trading to end at 5,008.10 on Monday, just 40 points from its March 2000 record.

The long climb back for the Nasdaq, once a symbol of investor recklessness and self-delusion, has been marked by significant changes in its composition.

Telecommunications stocks now represent less than 1 percent of the index, versus 12 percent in 2000.

Gone also is the heavy reliance on Internet companies with little or no earnings, like Pets.com and Webvan.

As a result, valuations are more modest.

Investors are now paying $20 for every $1 in earnings per share thrown off by Nasdaq companies each year. During the dot-com frenzy, they were willing to pay $194 for every dollar.

“It has gone up for the right reasons — on fundamentals, not just speculation,” said Peter Cardillo, chief market economist at Rockwell Global Capital.

On Monday, investors cheered a government report that showed household incomes rose in January, though consumer spending fell. Consumer discretionary stocks rose 1.2 percent on the news, the most of the 10 industry sectors of the Standard and Poor’s 500 index.

Read more:

http://www.bloomberg.com/news/videos/2015-03-02/nasdaq-returns-to-5-000-for-first-time-in-15-years

Recent Comments