DOW THEORY

THE DOW THEORY is a theory that addresses the movement of prices and provides a technical basis for its analysis.

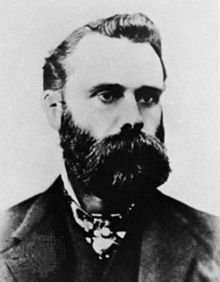

Charles Henry Dow formulated in 1884 the theory that has formed the basis of ANALYSIS GRAPHIC best known for TECHNICAL ANALYSIS.

Charles Dow, American journalist, was the co-founder of DOW JONES Co. along with Edward Jones and Charles Bergstresser.

DOW founded the THE WALL STREET JOURNAL and as a result of his research on the movement of markets, created the first stock index, the DOW JONES INDUSTRIAL AVERAGE (DJIA).

1) MARKETS ALL CASH.

All possible factors that affect the price of the asset, are discounted by the market players. They consider and incorporate instantly in price, all the news, accounting and financial results, extraordinary events, etc.

2) THE MARKET MOVES FOR 3 TRENDS.

Trends can be high or low, and may also be lateralization.

The trends are broken down according to their duration in:

PRIMARY TREND = TIDE (busiest sea); can last for months or years.

SECONDARY TREND = WAVES (formed with the rise or fall of the tide); can last from three weeks to three months. Functions as correction movements and can resume between 1/3 and 2/3 of the move.

TREND TERTIARY = RIPPLES (slight wave surface formed between the waves); lasting less than three weeks.

3) PRIMARY TRENDS HAVE 3 PHASES.

For Dow, the main trends (primary) are composed by:

Accumulation Phase. The best time to buy an asset, usually enjoyed by investors better prepared. It is the time when the market has assimilated all the negative information that held the downtrend, and is showing signs of reversal to an uptrend.

Phase Public Participation. The stage at which most investors trend followers begin to purchase the asset. The price engages the trend and occur rapid and significant price rises, with the market to assimilate the new good news.

Distribution phase. It appears when newspapers began writing about the substantial increase in the asset gains, the volume of operations and begins to increase public participation becomes even greater. This is where the savvy investors who entered active in the accumulation phase to begin to undo their positions, pocketing the profit.

4) VOLUME CONVERGENT

Dow recognizes the volume as a secondary factor, but important for new price trends are confirmed. To change the market trend, there should be a significant increase in volume in the negotiations. Dow believed that while there were no high volume to confirm the trend change, maintaining the previous trend.

5) PRINCIPLE OF CONFIRMATION.

The indices and means must confirm each other.

To check a trend is necessary that the behavior of the indices coincide with the trend. Uses the closing prices for the calculation of averages, not considering the maximum and minimum for the calculation of indices.

6) THE TRENDOCCURSWHILETHERE IS NOSIGNSOFREVERSAL.

The trend is effective until replaced by another opposite. Until the contents are confirmed, it is considered that the former tendency remains in place despite the apparent signs of change. This principle seeks to prevent premature exchange position (long or short).

CRITICISM TO THE DOW THEORY

Although the Dow theory have done a good job predicting various situations markets for high and low, it did not escape for some criticism over the more than 100 years. In general Dow Theory loses 20% to 25% of a motion before generating a trend signal, which many traders considered to be too late join.

A buy signal is given when the price breaks the value of the previous peak, indicating that a new peak above this will be formed. This point is precisely the value in many technical systems to follow trends point to purchase and begin to participate in the movement.

Supporters of his theories, say DOW never aimed to predict market trends. I just wanted to capture a significant part of the really important movements of the market, identifying trends with the necessary confirmations.

Which independently be the reason, clearly understand the fundamentals of Dow Theory is critical to be able to use technical analysis tools properly.

APPLE replaces ATeT in the Dow Jones Index

David Blitzer director of S & P and Dow Jones, author of “Using Indices to Beat Wall Street’s savviest Money Managers”, recently announced the entry of APPLE to the DJI.

The DOW JONES INDEX began in 1896, has the support of the Wall Street Journal and all companies wish to be present in the index.

Being an undeniable truth that the more you know better you are, the same goes for the DJI since the longer is the most reliable series it is..

However, its entry into an exclusive club defined by The Dow, the oldest and most followed market measure, still confers more recognition.

The market changes, the economy shifts and the Dow changes as well.

Only one company, GENERAL ELECTRIC (GE) ($25,64), of the current 30 is an original member from 1896, and it is very different today from what it was 119 years ago.

The 3 reasons to include APPLE in the DJI:

1 – The DJI adjustment decisions are based on the best representation of the market.

Apple being the largest company in the world is an obvious choice for the Dow.

It is a strong and reliable company in the leadership of the sectors in which operates and recognized globally.

Despite a market cap of $747Billion, far above the $10B. required, experts consider that the weight of APPLE is not excessive. The impact on the index is proportional to the weight of the company

2 – Apple was worth $700 in June which would distort the index, but in the meantime made a Stock-Split 7: 1

VISA, the technological company that also integrates the DJI is currently worth $265 but will make a Stock-Split 4: 1 which will lower the price ($70) and consequently lower the value of the index.

By joining Apple ($128.47) promotes the balance

3 – APPLE has extended its activity in the telecommunications sector.

AT&T ($33.59) and VERIZON ($49.54) are both companies with similar activities and with its “core” in communications.

Since AT&T as a lower value it is the chosen to leave, despite the operators believe that trust must be maintained and the price should not be affected.

Dow is a weighted price index, the lowest price of its shares, the lowest impact on the index.

Some say VERIZON will become more consolidated in the DJ30 because there is no more telecommunications companies present.

Read more:

http://www.indexologyblog.com/

http://www.marketwatch.com/investing/index/djia

Recent Comments