GOLDMAN SACHS IS IN A BULISH LEVEL AND A OPPORTUNITY OF INVESTMENT

Goldman Sachs Group Inc (NYSE:GS) provides investment banking, securities and asset management services.

In terms of technical analysis, this is a BULISH LEVEL.

The company core business is institutional client services.

as a MARKET VALUE of 89.5Bn$

The labor force includes 15455 EMPLOYEES.

The TURNOVER in 2014 was 8Bn$ and in 2015 the ESTIMATED TURNOVER is 35.6Bn$.

The NET INCOME in 2014 was 9.3Bn$ and in 2015 the ESTIMATED NET INCOME is 8.6Bn$.

His NET FINANCIAL POSITION is NEGATIVE with 322.9Bn$ in Debt.

Company RISK BETA is HIGH = 1.2

The PRICE EARNINGS are GOOD = 10.5 (sector average = 50.6).

PRICE BOOK VALUE is GOOD = 1.2 (sector average = 2).

DIVIDEND YIELD is NOT SO GOOD = 1.2% (sector average = 2.6%).

The average PRICE SALES is LOW = 2.5$ (sector average = 3.8$).

Comparing with the sector average, at this levels it IS A GOOD OPPORTUNITY for long term INVESTMENT.

Read more:

COCA COLA IS IN A BULISH LEVEL, THERE IS A OPPORTUNITY OF INVESTMENT

The Coca-Cola Co (NYSE:KO), manufactures, wholesales and retails nonalcoholic beverages.

In terms of technical analysis, this is a BULISH LEVEL.

The company core business is nonalcoholic beverages

COCA COLA as a MARKET VALUE of 176.9Bn$

The labor force includes 129200 EMPLOYEES.

The TURNOVER in 2014 was 46.1Bn$ and in 2015 the ESTIMATED TURNOVER is 44.9Bn$.

The NET INCOME in 2014 was 7Bn$ and in 2015 the ESTIMATED NET INCOME is 8.8Bn$.

His NET FINANCIAL POSITION is NEGATIVE with 20.1Bn$ in Debt.

Company RISK BETA is LOW = 0.5

The PRICE EARNINGS are NOT SO GOOD = 25.5 (sector average = 16.4).

PRICE BOOK VALUE is GOOD = 5.8 (sector average = 10.2).

DIVIDEND YIELD is GOOD = 3.1% (sector average = 2%).

The average PRICE SALES is HIGH = 3.9$ (sector average = 2.9$).

The ENTERPRISE MULTIPLE is NOT SO GOOD = 16.7 (sector average = 14.9).

CURRENT RATIO is NOT SO GOOD = 1 (sector average = 1.6).

Comparing with the sector average, at this levels it IS NOT A GOOD OPPORTUNITY for long term INVESTMENT.

Read more:

ROYAL DUTCH SHELL IS IN A WARNING LEVEL, BUT THERE IS A OPPORTUNITY OF INVESTMENT

Royal Dutch Shell Plc (AMS:RDSA), is an Anglo-Dutch multinational oil and gas company. Shell is vertically integrated and is active in every area of the oil and gas industry, including exploration and production, refining, distribution and marketing, petrochemicals, power generation and trading. It has minor renewable energy activities in the form of biofuels and wind.

In terms of technical analysis, this is a WARNING LEVEL.

The company core business is downstream.

SHELL as a MARKET VALUE of 256.5Bn$

The labor force includes 92000 EMPLOYEES.

The TURNOVER in 2014 was 451.2Bn$.

The NET INCOME in 2013 was 16.4Bn$.

His NET FINANCIAL POSITION is NEGATIVE with 45.3Bn$ in Debt.

Company RISK BETA is LOW = 0.7

The PRICE EARNINGS are GOOD = 12.3 (sector average = 13.5).

PRICE BOOK VALUE is GOOD = 1.4 (sector average = 2).

DIVIDEND YIELD is GOOD = 4.6% (sector average = 2.7%).

The average PRICE SALES is LOW = 0.6$ (sector average = 1.8$).

The ENTERPRISE MULTIPLE is GOOD = 5.6 (sector average = 19.7).

CURRENT RATIO is NOT SO GOOD = 1.2(sector average = 1.3).

Comparing with the sector average, at this levels it IS A GOOD OPPORTUNITY for long term INVESTMENT.

Read more:

GM IS IN A WARNING LEVEL. THERE IS A OPPORTUNITY OF INVESTMENT

GM – GENERAL MOTORS co, develops, manufactures and markets cars, trucks and parts.

In terms of technical analysis, this is a WARNING LEVEL.

The company core business is based in American cars.

GM as a MARKET VALUE of 57.1Bn$

The labor force includes 216000 EMPLOYEES.

The TURNOVER in 2014 was 154.2Bn$ and in 2015 the ESTIMATED TURNOVER is 149.6Bn$.

The NET INCOME in 2014 was 4.7Bn$ and in 2015 the ESTIMATED NET INCOME is 7.5Bn$.

His NET FINANCIAL POSITION is NEGATIVE with 17.3Bn$ in Debt.

Company RISK BETA is HIGH = 1.1

The PRICE EARNINGS are GOOD = 16.5 (sector average = 20.6).

PRICE BOOK VALUE is GOOD = 1.6 (sector average = 3.1).

DIVIDEND YIELD is GOOD = 3.4% (sector average = 2.1%).

The average PRICE SALES is LOW = 0.4$ (sector average = 1.7$).

The ENTERPRISE MULTIPLE is GOOD = 8.7 (sector average = 20.3).

CURRENT RATIO is NOT SO GOOD = 1.3 (sector average = 1.9).

Comparing with the sector average, at this levels it IS A GOOD OPPORTUNITY for long term INVESTMENT.

Read more:

NETFLIX IS IN A BULISH LEVEL. THERE IS NOT A OPPORTUNITY OF INVESTMENT.

NETFLIX Inc. (NASDAQ:NFLX) provides online movie rental subscription services.

In terms of technical analysis this is a BULISH LEVEL.

The company core business is domestic streaming.

NETFLIX as a MARKET VALUE of 34.1Bn$

The labor force includes 2450 EMPLOYEES.

The TURNOVER in 2014 was 5.8Bn$ and in 2015 the ESTIMATED TURNOVER is 6.8Bn$.

The NET INCOME in 2014 was 237Bn$ and in 2015 the ESTIMATED NET INCOME is 88Bn$.

His NET FINANCIAL POSITION is Positive with 679Mn$ in Cash.

Company risk BETA is HIGH = 1.3

The PRICE EARNINGS are not so good = 146.6 (sector average = 22.9).

PRICE BOOK VALUE is not so good = 17.9 (sector average = 5.9).

DIVIDEND YIELD is not so good = 0% (sector average = 2.1%).

The average PRICE SALES is high = 6$ (sector average = 3.1$).

The ENTERPRISE MULTIPLE is good = 6.4 (sector average = 17).

CURRENT RATIO is good = 1.5 (sector average = 1.4).

Comparing with the sector average, at this levels it is not a good opportunity for long term investment.

Read more:

BANK OF AMERICA IS IN A BULISH LEVEL. THERE IS A OPPORTUNITY OF INVESTMENT.

BANK OF AMERICA Corp. (NYSE:BAC) is a Bank holding company.

In terms of technical analysis, this is a BULISH LEVEL.

The company core business is Consumer and Business Banking.

BANK OF AMERICA as a MARKET VALUE of 168,1Bn$

The labor force includes 101818 EMPLOYEES

The TURNOVER in 2014 was 49,9Bn$ and in 2015 the ESTIMATED TURNOVER is 85,6Bn$.

The NET INCOME in 2014 was 8,5Bn$ and in 2015 the ESTIMATED NET INCOME is 14,9Bn$.

His NET FINANCIAL POSITION is Negative with 337Bn$ in Debt.

Company risk BETA is high = 1,2.

The PRICE EARNINGS are good = 23,5 (sector average = 50,6).

PRICE BOOK VALUE is good = 0,7 (sector average = 2 ).

DIVIDEND YIELD is good not so good = 1% (sector average = 2,6%).

The average PRICE SALES is low = 1,9$ (sector average = 3,8$).

Comparing with the sector average, at this levels it is a good opportunity for long term investment.

Read more:

http://investor.bankofamerica.com/phoenix.zhtml?c=71595&p=irol-irhome

GOOGLE IS IN A TECHNICHAL WARNING LEVEL, BUT A OPPORTUNITY OF INVESTMENT.

GOOGLE Inc (NASDAQ:GOOGL) operates as internet portal and search index website.

In terms of technical analysis this is a WARNING LEVEL

The company core business is the search engine.

GOOGLE as a MARKET VALUE of 349,9Bn$

The labor force includes 53600 EMPLOYEES

The TURNOVER in 2014 was 67,7Bn$ and in 2015 the ESTIMATED TURNOVER is 59,8Bn$.

The NET INCOME in 2014 was 13,9Bn$ and in 2015 the ESTIMATED NET INCOME is 19,6Bn$.

His NET FINANCIAL POSITION is Positive 59158Mn$ in Cash.

Company risk BETA is ok = 1.

The PRICE EARNINGS are good = 27,9 (sector average = 29,7).

PRICE BOOK VALUE is good = 3,5 (sector average = 5,8).

DIVIDEND YIELD is not so good = 0% (sector average = 1,2%).

The average PRICE SALES is high = 5,7$ (sector average = 4,8$).

The ENTERPRISE MULTIPLE is good = 14,3 (sector average = 16,9).

CURRENT RATIO is good = 4,8 (sector average = 1,9).

Comparing with the sector average, at this levels it is a good opportunity for long term investment.

Read more:

AMERICAN EXPRESS IN A WARNING LEVEL, A OPPORTUNITY TO INVEST

AMERICAN EXPRESS Company (NYSE:AXP) provides credit card, financial and global travel services.

In terms of technical analysis this is a WARNING LEVEL

The company core business is Card Services

AMERICAN EXPRESS as a MARKET VALUE of 78,4Bn$

The labor force includes 24545 EMPLOYEES

The TURNOVER in 2014 was 35,8Bn$ and in 2015 the ESTIMATED TURNOVER is 33,5Bn$.

The NET INCOME in 2014 was 5,9Bn$ and in 2015 the ESTIMATED NET INCOME is 5,5Bn$.

His NET FINANCIAL POSITION is Negative with 39,4Bn$ in Debt.

Company risk BETA is high = 1,1.

The PRICE EARNINGS are good = 13,5 (sector average = 50,6 ).

PRICE BOOK VALUE is not so good = 3,6 (sector average = 2 ).

DIVIDEND YIELD is not so good = 1,3% (sector average = 2,6% ).

The average PRICE SALES is low = 2,2$ (sector average = 3,8$).

Comparing with the sector average, at this levels there is a opportunity for long term investment.

Read more:

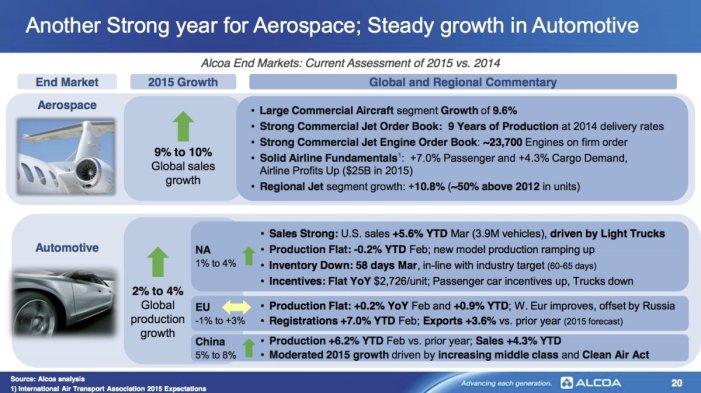

ALCOA´s earnings and outlook for the global economy

Alcoa is always the first presenting results and reported this quarter earnings.

Alcoa beat expectations per share while missing on revenue.

This giant of aluminum reported adjusted earnings per share of $0.28 against expectations for $0.26.

Revenue missed, however, coming in at $5.82 billion against expectations for $5.94 billion.

Alcoa’s report marks the unofficial start to earnings season.

Wall Street expectations for first quarter earnings have been ratcheted down significantly ahead of the start of earnings season, with earnings for the S&P 500 expected to decline 4,2% over the prior year, mostly owing to the decline in oil prices and the rally in the US dollar.

In its report, Alcoa maintained its 2015 growth projections for the aerospace, automotive, building and construction, industrial gas turbine, and packaging end markets.

The company also reaffirmed its outlook for growth in the aerospace, automotive, building, industrial gas, and packaging end markets.

Alcoa also lifted its final demand outlook for aluminum in 2015.

Read more:

http://www.alcoa.com/global/en/investment/info_page/home.asp

http://www.alcoa.com/global/en/news/news_detail.asp?pageID=20150306000262en&newsYear=2015

Recent Comments